CHD Partners entered the AMLCTF space in 2009 when several clients were selected for the first round of desktop audits in Clubs.

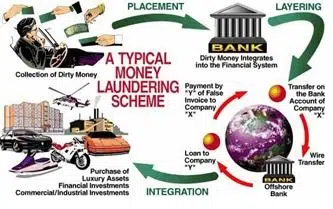

Anti Money Laundering and Counter Terrorism Financing

Reducing Fraud and Dishonesty

CHD Partners worked with our clients in collaboration with AUSTAC to develop a compliant AMLCTF program to meet the needs and complexity of Clubs.

CHD Partners has also had experience with full AUSTRAC audits at Clubs.

CHD understands that Clubs are very different to financial institutions and complexity includes casualisation of staff, limited specialised services in small venues such as human resources, gaming analysts or gaming attendants.

Each club is different and varies in complexity depending on location such as metropolitan or country, bowling, golf or ex-services.

No one size program will fit.

CHD Partners understands the needs of Clubs and values the contribution they make community and will assist all clubs large and small to meet their AMLCTF compliance requirements.

Program Objectives

The objectives of the program are to:

1. Draw together the organisations existing approaches to AMLCTF compliance.

2. Ensure greater compliance by implementing and documenting evidence to provide consistency across the organisation.

3. Provide the organisation with evidence that will demonstrate the organisations commitment to effective evidence-based compliance and risk management.

4. Enable the organisation to demonstrate rigour in the delivery of compliance, which will provide evidence to AUSTRAC if an audit occurred.

5. Conduct venue, customer and staff risk assessments.

6. Develop Part A and Part B of program.

7. Provide CIRT to manage all compliance and evidence online.

Quick Program Review Checklist

Not sure where to start. Please complete our free online desktop review checklist to provide you an indication of what your AMCTF Program should include. Complete Survey Now